|

The Global

Medical Injection Molding Market

The global medical injection molding market size was

valued at USD 1.38 billion in 2019 and is expected to grow at a compound annual

growth rate (CAGR) of 8.2% from 2020 to 2027. The increasing demand for plastic

and metal injection molded components in the medical industry is expected to

drive the market over the forecast period. Moreover, the growth of the home

healthcare sector on account of the low costs involved as compared to hospital

care and intensive care has resulted in a rise in the demand for medical

devices. Different types of medical tests conducted by hospitals for diagnosis

have also contributed to the increasing demand for medical devices. The rising

geriatric population in the country, sophisticated healthcare infrastructure,

and relatively higher disposable income levels are some of the key factors

driving the healthcare industry in the U.S. In addition, the country has the

highest healthcare spending in the world.

Factors, such as ISO certifications & compliance,

FDA regulations, material properties, suitability in extreme conditions, and

durability are taken into consideration during the manufacturing process.

Materials such as silicone, polycarbonate, polyethylene, and polypropylene, are

widely used in the medical injection molding process. It is one of the primary

processes that many companies adopt to manufacture medical products by using

plastic as well as metal materials.

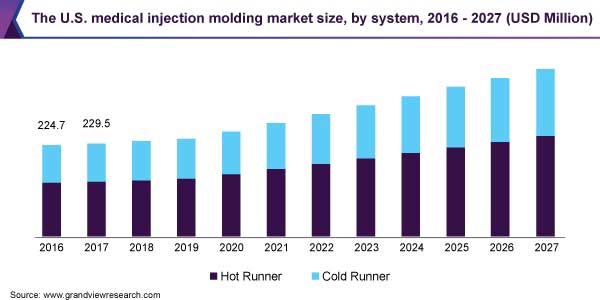

System Insights

The hot runner system held the largest market share

of over 55% in 2019 and is expected to exhibit the fastest CAGR over the

forecast period. Hot sprinter molds consist of two plates, which are heated

using a complex framework. This framework maintains the temperature of liquid

thermoplastics at the same level as their warming chamber. As a result, the

demand for the hot runner system is high.

Moreover, several benefits of hot runner system

including faster cycle time and lower pressure requirement to push the molten

mixture into the mold cavity, as well as the elimination of waste due to the

absence of runners, accommodation of larger parts with a higher volume of

production, and improvement in consistency & quality of parts, are augmenting

the segment growth.

The use of cold runner system depends on its

advantages, such as easy maintenance and cost-effectiveness; it is suitable for

various types of polymers. This system is a feasible option as it can produce

higher quality parts. Therefore, the application of cold runner systems is

growing at a significant rate owing to lower initial investments compared with

other systems.

In addition, flexibility in designing options,

capabilities of handling a variety of engineered thermoplastics, and flexibility

in gate locations, which can be easily changed or upgraded, will boost the

demand for cold runner systems. However, the demand for hot runner is higher

owing to its better efficiency.

Class Insights

Class III medical device segment accounted for 38.4%

of the overall revenue share in 2019. Class III medical devices, such as

defibrillators, ventilators, respirators, and oxygen therapy equipment, are

anticipated to have a significant demand on account of the COVID-19 pandemic.

The growing adoption of injection molding to manufacture medical device

components is projected to drive the segment growth over the forecast period.

Overall 10.0% of all the medical devices fall under

this category. These devices are capable of handling the substantial risk of

injury and are designed with the balance of strong cyber security control and

easy accessibility. Class III includes devices such as implanted pacemakers,

heart valves, and cerebral simulator.

Injection molding is used to produce a broad range

of medical components; it widely used processes in mass production. It has the

ability to produce components and small disposable goods with high precision.

Growing adoption of injection molding to produce numerous parts and components

of Class I medical devices is expected to have a positive impact on market

growth over the coming years.

The Class II segment is projected to register the

fastest CAGR over the forecast period. Injection molding offers several

advantages over other methods, such as lower risk, higher safety, and high

productivity. Furthermore, the growing penetration of plastic injection molded

products in the medical industry is expected to drive market growth over the

forecast period.

Material Insights

The plastic material segment in the medical industry

accounted for 76.0% of the overall revenue share in 2019. Engineering grade

plastic resins are beneficial when used for the manufacturing of medical and

pharmaceutical products as they have high tensile strength, metal tolerance, and

temperature resistance. Furthermore, they also reduce waste, weight, and the

overall cost of production.

Plastic injection molding is a feasible technique

for manufacturing complicated designs of medical products. Demand for

medical-grade injection-molded products is increasing as they are durable,

naturally resistant to contaminants & chemicals, and offer economies of scale to

large scale firms. As a result, the penetration of the material is expected to

witness significant growth.

(Ref.:

https://www.grandviewresearch.com/industryanalysis/medical-injection-molding-market

).

|