|

Niti Aayog proposes separate regulator for

medical devices

The ministry had issued a draft notification saying that all

medical devices would come under the category of drugs from December 1 and would

be regulated under the Drugs & Cosmetics Act.

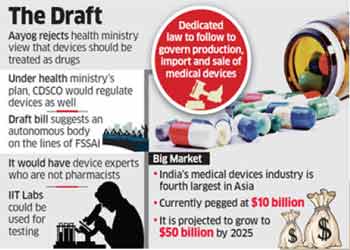

NEW DELHI: Government think tank Niti Aayog has rejected the

health ministry’s proposal to bring medical devices under the Central Drugs

Standard Control Organisation (CDSCO), saying the body does not have the

required expertise. People aware of the matter said the Aayog has instead moved

a draft Bill proposing that medical devices be governed by a separate regulator.

Earlier this month, the ministry had issued a draft

notification saying that all medical devices would come under the category of

drugs from December 1 and would be regulated under the Drugs & Cosmetics Act.

A senior official confirmed to ET that there is some support

for Niti Aayog’s view in the government that it is inappropriate to allow CDSCO

to regulate medical devices as they have expertise in pharmacy/chemicals and not

in devices.

People familiar with the development told ET that the Aayog

has floated a draft Bill to regulate over 6,000 bio medical devices in the

country.

“The Bill proposes a separate regulator for medical devices

on the lines of the Food Safety and Standards Authority of India (FSSAI), an

autonomous body under the health ministry,” one of the persons cited earlier

said, requesting not to be named.

In India, only 23 categories of medical devices are regulated

under the Drugs and Cosmetics (D&C) Act. The ministry’s notification said all

medical devices will be brought under regulation in a phased manner.

It has proposed seven categories of devices intended for use

in human beings or animals as drugs with effect from December 1, 2019, while

ultrasound equipment would be treated as drugs from November 1, 2020.

“Ministry of health should clearly define that its current

regulations to define devices as drugs and their regulation by CDSCO is a

temporary measure till a separate medical devices law and a competent regulatory

authority is formed as devices are not drugs,” Rajiv Nath, forum coordinator of

the Association of Indian Medical Devices Industry said.

India’s medical devices market is the fourth largest in Asia

- after Japan, China and South Korea–at over $10 billion and is projected to

grow to $50 billion by 2025.

https://economictimes.indiatimes.com/industry/healthcare/biotech/healthcare/niti-aayog-proposes-separate-regulatorfor-medical-devices/articleshow/71798635.cms

India Wooing Japanese Medical Device Firms

to Cut Reliance on US

The government is exploring all possibilities to attract

Japanese investment in India’s medical devices sector, a move which is likely to

reduce the country’s dependence on US manufacturers.

Price curbs imposed on medical devices have irked US

companies and become a key trade issue between Washington and New Delhi. Even as

the US is sparring with India over this, the focus is now on fast-tracking

investments from other countries, especially Japan, said people who are part of

the discuss.

PD Vaghela, the secretary at the Department of

Pharmaceuticals under the Ministry of Chemicals and Fertilisers, held a

high-level meeting with industry executives and government officials to discuss

the current status of investments in medical devices, how to maximise Japanese

investments and the regulatory issues. Representatives of Japanese companies

like Omron Healthcare, Teremo Corp, Shimadzu Corp, Sysmex Corp, Horiba India,

HitachiNSE -1.18 % India, Toshiba, CuraNSE 0.00 % Healthcare and the Japan

Federation of Medical Devices Association, and the first secretary at the

Embassy of Japan in India attended the November 8 meeting.

Officials from the Ministry of Health, Department of

Promotion of Industry and Internal Trade, Drug Controller General of India, and

representatives from the CII, Ficci, Andhra Pradesh Medtech Zone and the

Association of Indian Medical Device Industry (AiMed) were also present.

“Top government and industry representatives from Japanese

companies and India deliberated various ways of strengthening the partnership

between both countries,” said a person.

While Japanese brands have been household names in India for

cameras, TVs and automobiles, the US remains the largest exporter of medical

devices to India, followed by Germany, China, Singapore and the Netherlands.

The government is now looking at enhanced cooperation from

Japanese investors to strengthen the domestic capacity of medical devices.

“Economic relations between India and Japan have vast

potential for growth, given the similarities that exist between the two

countries. Vision 2025 outlined by both countries aims to strengthen Indo-Japan

relations by synergising business partnerships, facilitating investments and

creating an empowering environment in India for Japanese investments. The

meeting was held in view of that,” said a senior government official.

India’s medical device market is projected to grow to $50

billion by 2025 from $10 billion now. It is the fourth largest in Asia, after

Japan, China and South Korea. Currently, India has 750-800 medical device

manufacturers, with an average investment of Rs 170-200 million and an average

turnover of Rs 450-500 million. While India allows 100% foreign direct

investment in medical devices on the automatic route, investors have been wary

due to the current regulatory environment.

India’s decision to slash prices of coronary stents by 85% in

2017 and then capping the prices of knee implants affected US exports, US trade

representative had said in 2018.

www.economictimes.indiatimes.com/articleshow/72016205.cms?utm_

source=contentofinterest&utm_medium=text&utm_campaign=cppst

|